You will soon get a break at the check-out and the bill at your favourite restaurant.

The federal government is moving to lift the tax on things like groceries, snacks, and kids clothing and add $250 to your bank account in the form of a rebate cheque

The Liberals want to put it in place on December 14 and are urging MP’s to support the measures.

The new tax break will apply to:

- Prepared foods, including vegetable trays, pre-made meals and salads, and sandwiches.

- Restaurant meals, whether dine-in, takeout, or delivery.

- Snacks, including chips, candy, and granola bars.

- Beer, wine, cider, and pre-mixed alcoholic beverages below 7 per cent ABV.

- Children’s clothing and footwear, car seats, and diapers.

- Children’s toys, such as board games, dolls, and video game consoles.

- Books, print newspapers, and puzzles for all ages.

- Christmas trees.

The plan is to keep the taxes off these items until February 15.

More cash in your account

The government is also offering $250 cheques to millions who worked and filed their tax returns in 2023.

You will qualify if you made under $150,000. They will be sent out or in your account early in the spring of next year and roughly 18.7 million will be eligible.

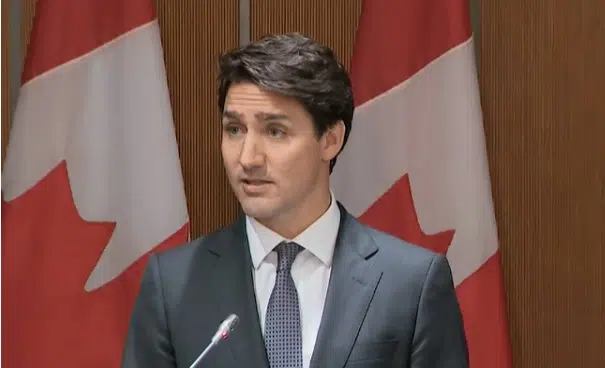

“Our government can’t set prices, but we can give Canadians, and especially working Canadians, more money back in their pocket. With a tax break for all Canadians and the Working Canadians Rebate, we’re making sure you can buy the things you need and save for the things you want.” said Prime Minister Justin Trudeau.

The NDP have already signaled support for the measures to pass it.