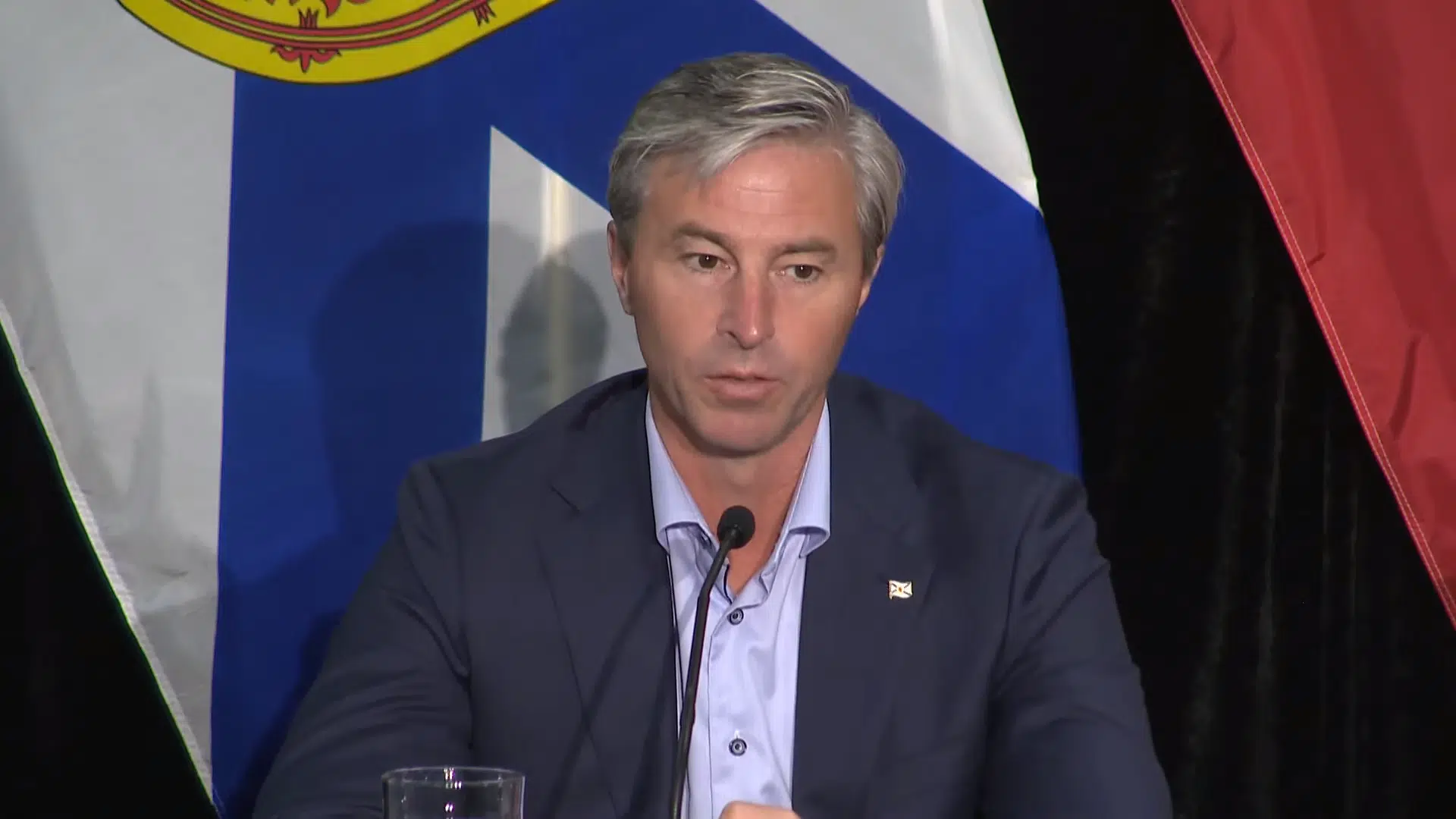

Nova Scotia Premier Tim Houston says the province doesn’t need the federal carbon tax to reduce emissions, according to a letter sent to Prime Minister Justin Trudeau.

Houston claims the province’s carbon emissions reduction plan is “better and more effective” at reducing carbon emissions.

“In fact, the last thing Nova Scotians need is another federal tax,” Houston writes in the letter.

Seven premiers across Canada, including Houston, asked Trudeau to pause the carbon tax or get rid of it.

Prime Minister Justin Trudeau has invited premiers to present their alternatives to the carbon tax. Their plans would have to meet or exceed the emission reductions of the federal plan, the government says.

“So all those premiers that are busy complaining about the price on pollution, but not putting forward a concrete alternative that they think would be better for their communities, are just playing politics,” the prime minister says at a Monday press conference.

“But we’re not seeing detailed plans from the premiers on this. They’d much rather try to complain about it and make political hay out of this,” says Trudeau.

The carbon tax increased on Monday. For example, self-serve regular gas is up 3.8 cents a litre to a minimum of $1.70 while diesel is up 4.6 to about $1.90 in Nova Scotia, according to the Utility and Review Board.

Houston’s letter includes the Still Better than a Carbon Tax Plan, a reference to a previous plan from 2022, where Houston also proposed an alternative to the carbon tax.

He writes that Nova Scotia has the “most aggressive targets” in the country. In multiple ways, he says, the province plans to do enough to reduce emissions.

The province wants greenhouse gas emissions to be 53 per cent lower than the levels emitted in 2005, according to a 2022 report from the Nova Scotia government.

Some of the initiatives listed in the letter include:

- Nova Scotia’s Coastal Protection Action Plan, which gives municipalities and people living on the coast guidelines for climate change adaptation

- Nova Scotia’s Climate Plan, a general plan to reduce carbon emissions and prepare for climate change

- Nova Scotia’s Clean Power Plan, which aims to make 80 per cent of electricity in the province renewable by 2030 and switch to net zero carbon emissions by 2050, he says

- Nova Scotia’s Green Hydrogen Action Plan, a plan to use and export “green hydrogen” and “hydrogen derivatives”

“Nova Scotians were doing all of this, and more, without a punitive, ineffective carbon tax,” the premier writes in the letter.

Coastal protection

The Nova Scotia government’s Coastal Protection Plan, for instance, is a replacement of previous coastal protection guidelines proposed by the former provincial Liberal government. It also focuses on mitigating the impacts of climate change rather than reducing greenhouse gas emissions.

The original Coastal Protection Act would have been the first of its kind in Canada, according to Ecology Action Centre, an environmental charity in Nova Scotia. The act would have regulated the development on land within a certain distance of the shore, protecting areas susceptible to erosion related to climate change.

Carbon tax rebate

The premier also doesn’t mention the carbon tax rebate in his letter. The rebate is available to anyone who files their taxes and is delivered every quarter.

The base amount for Nova Scotia is:

- $103 for an individual

- $51.50 for a spouse or common-law partner

- $25.75 per child under 19

- $51.50 for the first child in a single-parent family

There’s also supplement for people living in rural areas who may not have easy access to greener alternatives to driving a motor vehicle, for example. The rural supplement is:

- $20.60 for an individual

- $10.30 for a spouse or common-law partner

- $5.15 per child under 19

- $10.30 for the first child in a single-parent family